SPRINGFIELD – State Senator Mattie Hunter (D-Chicago) joined her colleagues in voting to allow the General Assembly to end the unfair flat income tax rate:

SPRINGFIELD – State Senator Mattie Hunter (D-Chicago) joined her colleagues in voting to allow the General Assembly to end the unfair flat income tax rate:

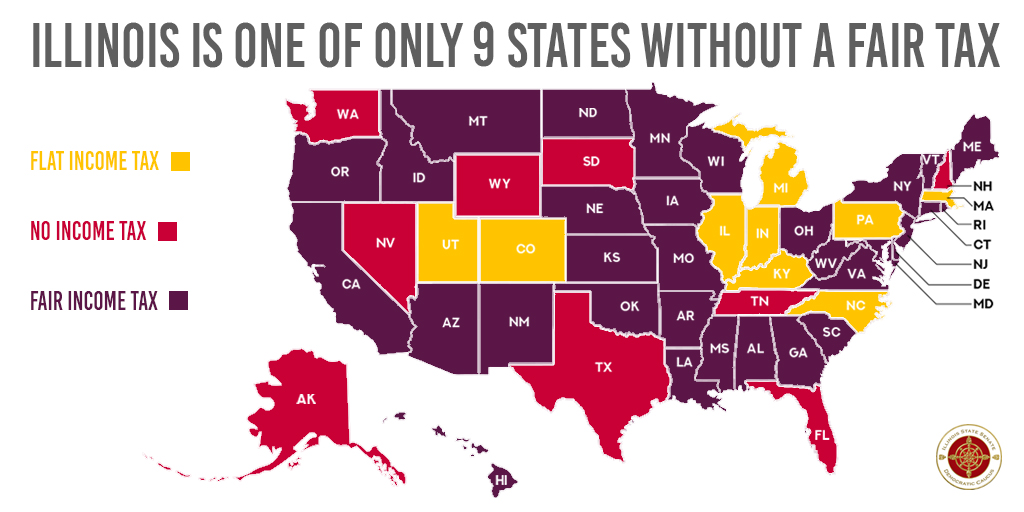

“Today, I chose to stand up for the hardworking men and women in our state who have struggled to put food on the table for their families and get ahead under an unfair tax system that places the same burden on a restaurant server that it does on billionaire investment bankers.

“Reforming our tax code so that the wealthy pay their fair share while easing the burden on 97 percent of all Illinoisans is the right thing to do. It will not only allow us to invest in our schools and social services and boost our local economies throughout the state, but it will help put Illinois on a responsible path to fiscal stability.”

If the amendment passes both the Senate and the House with a three-fifths supermajority vote, it will be placed as a question on the November 2020 ballot. The Constitution will be amended if 60 percent of those voting on the question approve it, or a simple majority of all voters in the election.

Senate Joint Resolution Constitutional Amendment 1 now heads to the House of Representatives for consideration.